Ever heard the story of Ronald Read? He was a janitor that had saved up a fortune of $8 million by the time he died (about 10 years ago).

How did he do it? Winning the lottery? Inheritance? Nope. He simply saved and invested his modest earnings (mostly in blue chip stocks), and let compound interest work its magic.

His story illustrates an important message: Getting wealthy does not require being a Wall Street wizard or having a Harvard degree; it’s often more about how we behave with money.

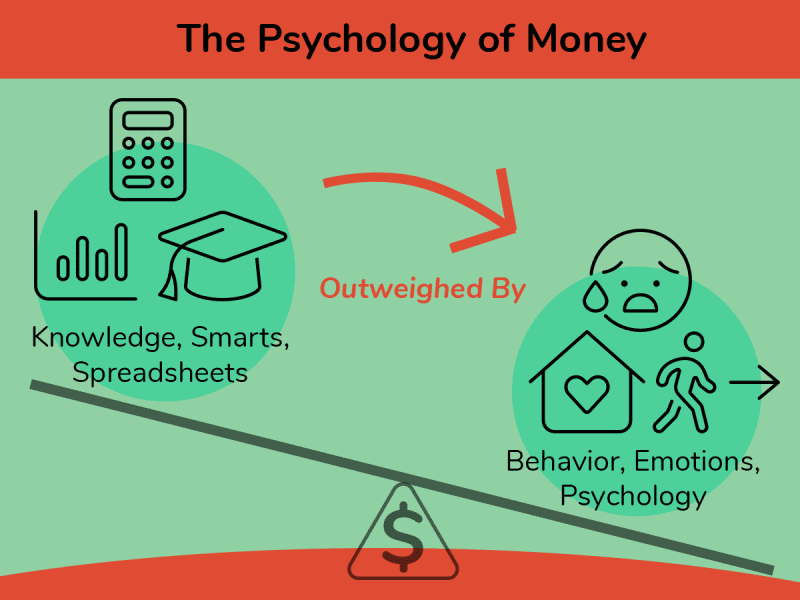

Many people believe that financial success is all about knowledge, numbers, and spreadsheets, but it’s really more about our behavior, emotions, and psychology.

This is the core message of this book—”The Psychology of Money” is about understanding why smart people often make dumb financial choices, and why our behavior with money is more important than how intelligent we are.

For example, why does the average low-income household in the U.S. spends $412 on lottery tickets every year, four times more than high-income households? To answer that question, we should look not at finance charts, but into people’s psychology, motivations, and dreams.

So, whether you’re drowning in debt, aspiring to be the next Warren Buffet, or somewhere in between, understanding the psychology behind money is crucial.

In this book summary of The Psychology of Money, we’ll unpack its best lessons and timeless wisdom. Because this book is heavily focused on the “human side” or “soft skills” of finance, you’ll probably want to supplement it with a book that provides immediate and actionable knowledge, like The Simple Path to Wealth by JL Collins. (Read our summary!)

Who is the author?

Morgan Housel is a partner at The Collaborative Fund. As a business and financial journalist, he won many awards while writing for The Wall Street Journal and The Motley Fool. His combination of unique research and engaging storytelling made The Psychology of Money a bestseller, with over 4 million copies sold.

👀 1. The “Never Enough” Trap: How social comparison and envy cause people to take foolish financial risks

Have you ever caught yourself looking at someone else’s success and thinking, “I want that too”? You’re not alone, but be careful—Feeling like we have “never enough” is the cause of many risky financial decisions.

Social comparison tends to make people feel envy and insecurity, powerful emotions that cloud our judgment. We end up chasing short-term financial gains, that make us lose money and feel less happy, because we lose sight of what truly matters.

Bernie Madoff was already living a life of luxury in New York City, running a well-respected investment company, but it was not enough. So he began running a Ponzi scheme, one of the biggest in history.

For years, Madoff tricked people into investing their money with him, promising them great returns. But instead of actually investing their money, he was using new investors’ money to pay off older ones. He made it look like everyone was making a lot of money, but it was all a lie.

Meanwhile, Madoff was taking millions for himself, buying fancy homes and yachts, and living the high life. In the end, he got caught and his scheme fell apart. He went to jail and many others lost everything, leaving a story of greed gone way too far.

The moral of the story? Be careful of “moving goalposts.” Constantly comparing ourselves with those a step above us financially, will lead to always feeling the need for more. Even someone in the top 1%—like Micheal Jordan, the richest athlete ever with $3.3 billion—could still compare himself to Jeff Bezos, the founder of Amazon who is almost 50 times more wealthy! Capitalism, warns Morgan Housel, is excellent at generating wealth, but also at generating envy.

So, how do we escape the “never enough” trap?

- Write down a clear, definite end goal. How much is “enough” to you?

- Beware the game of social comparison. People around us have a powerful influence on us, we need to be careful to focus on the game we’re playing, not getting distracted by others playing a different game.

Most importantly, there are things in life never worth risking, like our reputation, freedom, family, and health. Keeping this in mind helps us avoid making financial decisions for short-term gains, that may risk what is most important to us.

“We will not trade something that we have and need for something that we don’t have and don’t need.”

—Warren Buffett

The classic book “Think and Grow Rich” by Napoleon Hill emphasizes the importance of having a clear vision for your own financial success and staying committed to your own journey, no matter what other people are saying or doing.

The most important idea in that book is we must have a very clearly defined goal of how much money we want, what specific date we will get it by, a detailed plan for how we will get it, and backed up by relentless perseverance. Once we have written down this definite goal and plan, the book says we must read that to ourselves twice daily in the morning and nighttime. And the most critical part? “As you read, see and feel and believe yourself already in possession of the money.”

Social comparison causes feelings of envy, insecurity, and greed, leading to poor financial decisions. The solution is to set a clear personal goal for how much is “enough” to stop the goalposts moving, and not getting distracted by other people playing a different game than us.

⏰ 2. Understand True Wealth: Happiness increases from having control over one’s time, not showing off material things

When we think about wealth, our minds often jump to material possessions. The big houses, flashy cars, and glamorous travel. But is that really what true wealth is about?

Here’s the quick summary in bullet-point form:

- We’re not really impressed by other people’s material things. Morgan Housel calls this the paradox of “the man in the car.” When we see someone driving an expensive car, we don’t think they are cool. We may think the car is cool, or imagine how cool we would look driving it. Yet, when we buy flashy items ourselves, we tend to believe it will improve others’ perceptions of us.

As the famous quote goes, “We buy things we don’t need with money we don’t have to impress people we don’t like.”

- Real wealth is not externally visible. Wealth is not the money someone has spent, but what they’ve saved and invested. That generally makes it hidden in assets like stocks and bonds. We’ve all heard the news stories about celebrities that appear to be incredibly rich buying expensive mansions and toys, then suddenly they’re bankrupt.

- Happiness comes from having control of our time, much more so than from income or other factors. We feel best when we can do what we want when we want. (This was backed by a series of studies by social psychologist Angus Campbell, published in his 1981 book The Sense of Wellbeing in America.

If this is all true, then the highest form of wealth is not high material consumption, but financial independence. That means having enough savings put aside to give us a sense of freedom, flexibility, and security. So we don’t need to worry about losing our job or how big our next paycheck will be.

“I did not intend to get rich. I just wanted to get independent.”

—Charlie Munger

A high savings rate is the most important tool for accumulating significant wealth. Why? Because people have become wealthy without a high income, like the janitor we mentioned at the beginning. But nobody can get wealthy if their lifestyle expenses grow faster than their income, and growing our income is never a sure thing anyway.

Most of us can save significantly more money by reducing our desires and ego. Many of our expenses come from social comparison, rather than being true needs. By increasing our humility, we can reach financial independence faster.

“The Millionaire Next Door” book echoes the same message. It says most of us are dead wrong about how the typical millionaire looks like. Their research discovered that an average millionaire is not a flashy consumer, contrary to popular belief. Instead, they are probably a blue-collar business owner with an average-sized house and unremarkable car.

They say most millionaires accumulated wealth not by having an exceptional income, but by playing great financial defense with careful budgeting and controlling expenses. One rule they give: If you want to become wealthy, don’t buy a house with a mortgage bigger than twice your annual income.

True wealth is not about what we can show off. It’s about saving and living humbly to gain control over your time and life. That is the true path to wellbeing.

💰 3. Compound Interest is Unbelievable: Warren Buffett’s “real secret” is not investing genius, but consistency over a long time

Ever wondered how Warren Buffet built such a colossal fortune, almost entirely through investing? The secret is not investment genius, but his unwavering consistency over decades, which has let him fully leverage the astonishing power of compound interest.

What is compound interest?

- Imagine you had $1 at the beginning of a month, and every day that dollar doubled (or compounded by 2X). So the 2nd day you had $2, then $4, then $8. Well, guess how much you’d have at the end of 30 days? The answer is a surprising $1,073,741,824—over $1 billion! However, if you started this compounding just one week later in the month, guess how much you’d have? Just over $8 million. A much more modest amount!

- Our minds cannot intuitively grasp exponential growth. That’s why it is so surprising that 3 weeks of doubling $1 would give us $8 million, and one week more would turn it into over $1 billion. Now let’s turn our attention back to practical finance to see how this applies.

- Compound interest is like your money making its own money. You can start with a little bit, and it grows a little each year by earning interest. But then, you start making money on the new amount, which includes the interest earned last year. So as time goes on, you make more and more money because you’re earning money on top of the money you’ve already earned. It’s like a snowball rolling down a hill, getting bigger and bigger as it goes.

Let’s take a closer look at Warren Buffett’s financial journey. He began investing at the age of 10, he was a millionaire by the age of 30, he had $25 million by the age of 40, he reached $1 billion by the age of 56, and today he’s worth over $110 billion. That means 99% of Buffett’s wealth came after he was around the age of retirement!

Warren Buffett’s real secret is not investment genius, but the sheer time he has spent invested in the market, allowing his money to grow by the power of compound interest.

Does that mean Buffett is a bad or mediocre investor? Not at all! His average return is an impressive 22% per year. But other investors have achieved much higher returns, such as Jim Simons, who had an average annual return of 66%. Yet Jim Simon’s net worth is only $30 billion, because he only began investing seriously in his 50’s, so his money had much less time to grow.

The practical takeaway? START NOW with saving and investing your money. The sooner you begin, the more time you’ll be in the market by the time you retire, and the wealthier you’ll be thanks to compound interest. The real power of investing comes with time. It requires patience and a long-term view to help us stay the course through the ups and downs.

But isn’t investing risky? There’s always risk, but we can reduce it by choosing the right type of investing. Like many other modern finance books, The Psychology of Money speaks highly of stock index funds, which provide strong diversification and average historical growth of over 10% per year, despite the volatility.

The bestselling money book “Rich Dad Poor Dad” by Robert Kiyosaki explains the difference between buying an asset versus a liability. That author says rich people acquire assets, which are things that grow in value over time and put cash flow in our pocket—like stocks, bonds, real estate, etc. Poor people spend more of their money on liabilities which decrease in value and cost money over time, like car loans, credit card debt, etc. Kiyosaki writes, “The poor and middle class work for money. The rich have money work for them.” (Through buying ASSETS.)

Read more in our summary of Rich Dad Poor Dad by Robert Kiyosaki

The secret behind Warren Buffett’s wealth is time and consistency, not only investing skill. We can leverage the power of compound interest by starting as soon as possible and setting realistic, long-term goals for financial success.

🆘 4. Make Room for the Unexpected: Secure your financial safety with a margin of safety for errors and tough times

Ever noticed some people seem to lose a ton of money in stocks while others just seem to get richer? It’s often not because they made bad investment choices, but because they made panic-driven decisions, not understanding how to handle the market’s inevitable ups and downs. In this next part, you’ll learn how to keep your money safe when the stock market gets wild and avoid making the most common and costly mistakes in investing…

“Everyone has a plan until they get punched in the face.”

—Mike Tyson

Investing has an emotional cost that most people don’t consider before they get in. We’re talking about those emotions like fear, self-doubt, and instability caused by the market going up and down like a rollercoaster—as it likes to do sometimes.

Studying investing in theory is a lot different than feeling the reality of suddenly losing 30% of our life savings during a market downturn. Even if we’re smart, it becomes difficult to control our behavior during those times and avoid being emotionally depleted.

Leaving room for error (having a margin of safety) is possibly the best strategy to reduce the emotional pain of market volatility. Rather than pursuing the investing plan that is mathematically optimal, this means choosing a path that may lead to less overall growth, but one we can stick to more sustainably. The strategy that gives us peace of mind and allows us to sleep at night.

(The idea of “margin of safety” actually comes from Benjamin Graham, the primary mentor of Warren Buffett and father of value investing.)

Some ways to have margin of safety:

- Also choosing stable, low-growth investments. By putting a greater percentage of our wealth into stable, yet lower-growth investment options like bonds, we create a safety net. This way, we’re less likely to panic-sell our investments during a market downturn, helping us stick to our long-term strategy for financial independence.

- Maintaining larger cash reserves, an emergency fund that is immediately available. For example, the finance guru Dave Ramsey recommends saving a $1000 mini emergency fund as quickly as possible. It’s the first step of his personal finance plan, even before paying off any debt. Later, Ramsey says to grow that fund to 3-6 months worth of expenses, that is at least $5,000. Learn more in our summary of The Total Money Makeover by Dave Ramsey.

- Underestimate your future earnings by 1/3. By expecting our future investment returns to be lower than they have been in the past, we can avoid the painful situation of being retired and running out of money. Housel says there’s a difference between getting money versus keeping money. Getting money often involves being optimistic and taking risks. But keeping money takes a different strategy, such as recognizing the role that luck played in our past success, and humbly preparing for the possibility things might not go as well in the future.

The key to financial stability is preparing for the unpredictable and reducing the emotional cost of investing. How? By maintaining a margin of safety in our investing strategy, to cushion us against unexpected mistakes and crashes.

⏳ 5. Recognize Luck & Risk: Success is not just hard work and skill—it’s also about timing and circumstances

Ever felt that it’s so unfair that some people seem to have it all, while others work just as hard but don’t succeed?

The truth is, the roads of success and failure are paved with more than just our effort and ability; they’re also made of luck and risk, factors completely out of our control. Acknowledging this reality can help us become more humble in success and resilient in failure.

Take Bill Gates as an example of luck. He’s obviously a very smart guy that worked really hard at something he was very skilled at. But he was also in the right place at the right time.

In 1968, having access to a computer in a school was very rare. In fact, the odds worldwide would be 1 in 1 million. This stroke of luck gave Bill Gates a huge head start. And he openly admits today that if he’d gone to a different school, there would be no Microsoft today.

Remaining humble in success. When we’re successful, it’s easy to get carried away thinking our results are solely because of our brilliant decisions. But remember, there are always critical factors outside of our control. We are like a sailor, that can control the sails and rudders of our ship. But the ocean underneath us, of luck and risk, is out of your hands.

Be kind to yourself in failure. On the flip side, there is risk. Sometimes we can make all the right decisions and work hard, yet still fail. Bill Gates had a classmate named Kent Evans, who was equally as intelligent as him, benefited equally from having a computer early on, but that boy died in a climbing accident. Also a 1 in 1 million event, a tragedy that illustrates risk.

Two practical takeaways from this insight:

- Recognize broader patterns. Rather than idolizing specific successful individuals and looking down at those people that seem to have failed. By focusing on common patterns and habits of successful people, we can learn what really works. This helps us avoid being fooled by luck and risk.

- Focus on what’s in your control…

To build our resilience and discipline, we can find inspiration in the ancient philosophy of Stoicism. A key tenet of Stoicism was that we should always focus on changing what is within our control, and accept with tranquility what is outside our control. So what we can change is our thoughts, attitudes and actions. What we cannot directly control are our circumstances and outcomes.

The philosopher Epictetus put it like this: “There is only one way to happiness and that is to cease worrying about things which are beyond the power of our will.”

To truly understand financial success and failure, we must also recognize factors outside of our control like luck and risk. So it is wise to remain humble and kind to ourselves and others. Looking more at the broad patterns of success, rather than idolizing specific individuals.

🎰 6. Tail Events: You can be wrong 99% of the time, and still end up ultra-successful

What if you discovered that even the most successful people are often wrong 99% of the time? And they may only be right 1% of the time, but it’s because of those rare wins they end up being ridiculously wealthy? Welcome to the fascinating concept of “tail events” in the world of business and investing.

A tail event is a rare situation in investing that has a really big impact, either making someone a lot of money or causing a big loss.

The reality of investing is that most investments either lose money or break even. Almost all the money comes from a small percentage of investments that become grand slam winners.

Here are some examples:

- Warren Buffett’s Portfolio. The famous investor has owned more than 400 stocks in his lifetime, but the majority of his wealth has come from just 10 stocks. A few outstanding wins make up for countless stocks that performed poorly.

- Amazon’s Business Strategy. While Amazon stock has been a major winner recently, most of the company’s projects end up as failures. When the Amazon Fire Phone failed spectacularly, then-CEO Jeff Bezos simply told stockholders that Amazon would have much bigger failures in the future. Their strategy is making lots of small bets, to find a few huge winners, like their cloud computing division AWS that has driven much of Amazon’s recent growth. (For more, read our summary of The Everything Store, a book all about the story of Jeff Bezos and Amazon.)

- Venture Capital Investing. In this type of investing, related to early-stage startups, investors expect the majority of the companies they invest in to lose money. However, perhaps 0.5% of the startups will end up being the next Tiktok or Uber and return 50X the money they invested, more than paying for all the little failures.

Have you ever head of Peter Thiel? He’s a billionaire tech investor and he was one of Elon Musk’s early business partners when they build PayPal together. In his book “Zero to One,” Peter Thiel makes a very similar point. He calls it “the biggest secret in venture capital”—that the returns from the ONE BEST INVESTMENT someone makes very often outweigh the returns from ALL their other investments combined. During Peter Thiel’s career, that exceptional investment was Facebook.

What are the practical takeaways from understanding “tail events”?

- Diversify your investments. Make a lot of small bets in a wide range of investments. If you’re using index funds, then you’re already ahead of most people. An index fund contains a bit of EVERY major stock in the market, so you will automatically benefit from the 1% of winners.

- Don’t sweat frequent small failures. Part of the game of business and investing is to have many small failures. In fact, you can view them less as failures, and more as experiments that didn’t work. Just make sure the cost of these individual failed experiments isn’t big enough to wipe you out financially.

In the unpredictable world of investments, often the best strategy is NOT trying to be right consistently. Instead, make a lot of small bets so you can benefit from the occasional home run. Embrace the failures and remember to diversify.

😰 7. Don’t Fall for Pessimism: Market downturns are scary but temporary—in reality the long-term trends are positive

When you open the financial section of the news, most of the time you’ll see at least one headline that hints the market is on the brink of a crash. This says more about the psychology of getting clicks, than the reality of the economy right now.

Let’s talk about how despite all the scary news stories, the long-term financial trends are upwards.

Challenging oversimplified narratives. We love stories and we naturally seek out the stories that support our existing beliefs. Such as the belief that everything is getting worse and worse. In psychology, this is called confirmation bias.

Negative events tend to be sudden and dramatic changes, lending themselves well to storytelling. While positive growth in the economy is slow and gradual, only visible through boring statistics, meaning it often flies under our radar. In short, bad news sells.

Another related concept is negativity bias, discussed by the renowned psychologist and Nobel laureate Daniel Kahneman in his book Thinking, Fast and Slow. His research found people generally weigh negative information 2.5 times more heavily than positive information. (This trait is probably rooted in evolution, as our ancestors needed to be alert to threats in order to survive.)

In practical terms, this means that negative experiences, criticism, and bad news have a much stronger impact on us than positive experiences, compliments, and good news. Here’s a fascinating related quote from Kahneman: “A reliable way to make people believe in falsehoods is frequent repetition, because familiarity is not easily distinguished from truth.”

Our tendency to become fixated on the negative can greatly influence our decision making, in life and finances. We may overemphasize potential risks and losses, and act so cautiously that we miss out on the long-term financial growth that investing provides.

Don’t be fooled by the attractiveness of pessimism narratives. Looking at economic trends over a longer timespan leads us to a more rational and reality-based optimism. This can let us spot opportunities we would miss if we only focus on the bad stuff.

- List 3 things you are grateful for regularly. This can help you avoid the “Never Enough” Trap, shifting your focus from what others have to what you have.

- Set up automatic contributions to a retirement account. Many online services called “Robo Advisors” now exist that can help us save and invest each month automatically. In the US, these include Betterment and Wealthfront, while in Canada you’ll find WealthSimple. By starting as early as possible and staying consistent with regular contributions, we can leverage the power of compound interest to grow our wealth.

- Build an emergency fund of at least $1000. If you have higher living expenses such as a mortgage and family, this will be higher. Eventually your emergency fund should be 3-6 months worth of expenses, says Dave Ramsey. This builds a margin of safety so you can stick with your investing plan during market crashes.

Community Notes