Ready to get smart with your money? We’ve got you covered! After digging through heaps of recommendations, we’ve handpicked the top 12 financial literacy books.

These aren’t just any books; they’re the most mentioned books on financial literacy out there. So you know they’re good because they’re the ones most experts recommend.

Money can be confusing, but it doesn’t have to be. Whether you’re already good at managing your money or you find it hard, there’s a book here that can help. These books will teach you how to budget, save, and invest the right way. Best of all, they are all easy to understand and full of actionable tips.

Ready to start? Let’s jump in and turn those money challenges into peace of mind!

Table of contents

- 1. The Psychology of Money by Morgan Housel (6 mentions)

- 2. The Total Money Makeover by Dave Ramsey (6 mentions)

- 3. Rich Dad Poor Dad by Robert Kiyosaki (6 mentions)

- 4. The Intelligent Investor by Benjamin Graham (6 mentions)

- 5. The Millionaire Next Door by T. Stanley and W. Danko (5 mentions)

- 6. The Richest Man in Babylon by George S. Clason (5 mentions)

- 7. Your Money or Your Life by J. Dominguez and V. Robin (5 mentions)

- 8. The Simple Path to Wealth by JL Collins (4 mentions)

- 9. Broke Millennial by Erin Lowry (4 mentions)

- 10. I Will Teach You to Be Rich by Ramit Sethi (4 mentions)

- 11. The Little Book of Common Sense Investing by John Bogle (3 mentions)

- 12. The Bogleheads' Guide to Investing by Lindauer, LeBoeuf, and Larimore (3 mentions)

1. The Psychology of Money by Morgan Housel (6 mentions)

—Morgan Housel

What is The Psychology of Money about?

What are the key takeaways?

- ⏰ 1. Understand True Wealth: Happiness increases from having control over one's time, not showing off material things

- 💰 2. Compound Interest is Unbelievable: Warren Buffett's "real secret" is not investing genius, but consistency over a long time

- 🆘 3. Make Room for the Unexpected: Secure your financial safety with a margin of safety for errors and tough times

Why should you read it?

I recommend this book because it's not just about getting rich; it's about cultivating a healthier, more self-aware approach to managing your finances and life. It's a must-read for anyone looking to navigate the complex world of money with a clearer mind.

Is it worth reading? Reviews Summary

The Psychology of Money is rated 4.7 on Amazon and 4.4 on Goodreads.

Positive reviews say: + Deep insights + Easy to read + Well-researched

Criticism: - Somewhat repetitive themes - Not a step-by-step guide

2. The Total Money Makeover by Dave Ramsey (6 mentions)

What is The Total Money Makeover about?

What are the key takeaways?

- 💰 1. Build a Mini Emergency Fund First: Start your financial journey by saving $1,000, creating an initial safety net

- ❄️ 2. Tackle Debt with the Snowball Method: Begin paying off your debts in order from smallest to largest, to build momentum and motivation

- 🏦 4. Set Aside 15% For Retirement: Dave Ramsey's personal strategy is to invest 15% of income, ensuring a comfortable retirement

Why should you read it?

If you're feeling stuck in a cycle of debt and financial stress, I highly recommend giving this book a read. There’s nothing complicated about Dave Ramsey's advice, folks! He just provides us with a common sense financial plan that works—if we’re willing to work the plan! 💪

Is it worth reading? Reviews Summary

The Total Money Makeover is rated 4.7 on Amazon and 4.2 on Goodreads.

Positive reviews say: + Practical steps + Motivational + Step-by-step plan

Criticism: - One-size-fits-all - Aggressive debt approach - Religious overtones

3. Rich Dad Poor Dad by Robert Kiyosaki (6 mentions)

What is Rich Dad Poor Dad about?

What are the key takeaways?

- 🏦 1. Understand Assets vs Liabilities: 'The Rich' buy assets that generate income, while 'The Poor' buy liabilities that cost them money (like a house and cars)

- 🧠 2. Master Your Psychology: We all have inner obstacles to wealth like fear, arrogance and laziness

- ⚖️ 3. Maximize Tax Advantages: Having a corporation can offer you many benefits including tax savings

Why should you read it?

Now, I know some people think the author is more of a salesman or even call him a fraud because of how he presents his ideas. But on the flip side, a lot of readers feel really fired up after reading the book. It's easy to understand and makes you see money in a whole new way, pushing you to take action towards financial freedom. 💸

Is it worth reading? Reviews Summary

Rich Dad Poor Dad is rated 4.7 on Amazon and 4.1 on Goodreads.

Positive reviews say: + Thought-provoking + Inspires entrepreneurship + Simple to understand

Criticism: - Oversimplified concepts - Undermines education and careers

4. The Intelligent Investor by Benjamin Graham (6 mentions)

“The intelligent investor is a realist who sells to optimists and buys from pessimists.” —Benjamin Graham

What is the book about?

The Intelligent Investor is a classic book on “value investing,” which focuses on identifying undervalued stocks. Benjamin Graham emphasizes a disciplined, long-term investing approach that goes beyond just looking at the stock price, to analyzing the underlying company’s fundamentals. Warren Buffett says it’s “by far the best book on investing.”

Why should you read it?

If you’ve ever 💭 daydreamed about becoming the next Warren Buffett, strutting around with groups of admiring fans soaking up your nuggets of investing wisdom, then this book should be next on your 📚 reading list! While “The Intelligent Investor” may be a classic today, the most important sections focus on timeless principles and remain as true as ever, like a perfectly aged fine wine. 🍷

Top lessons include:

- 🧐 Embrace Value Investing: Focus on stocks that are undervalued but have solid fundamentals. Look for consistent growth, strong management, steady dividends, and reasonable pricing.

- 🔒 Prioritize Margin of Safety: Buy stocks at prices well below their real value. This approach reduces risk and protects against market volatility and errors in judgment.

- 🎢 Understand Mr. Market’s Mood Swings: Recognize the market’s irrational behavior through the Mr. Market analogy. Be aware of its overreactions, both optimistic and pessimistic, and don’t let these swings dictate your investment decisions.

Is it worth reading? Reviews summary:

| ⭐️ 4.7 on Amazon | ⭐️ 4.3 on Goodreads |

| 👍 Positive: Many feel the book is essential reading for a deeper understanding of investing. | 👎 Criticism: Some didn’t like the newer commentary in the book that seems to contradict Graham’s value investing. |

5. The Millionaire Next Door by T. Stanley and W. Danko (5 mentions)

—Thomas J. Stanley William D. Danko

What is The Millionaire Next Door about?

What are the key takeaways?

- 🐷 1. Embrace Frugality: Financial planning and saving money is essential for creating your foundation for investment and future wealth

- 🏎️ 2. Avoid Status Traps: One of the biggest obstacles to wealth is the temptation to live a high-status lifestyle

- 🌱 3. Acquire Assets: Millionaires grow wealth effectively by looking beyond their income and accumulating financial assets

Why should you read it?

If you're curious about what it really takes to build wealth over a lifetime, without the glitz and glamour often portrayed in the media, I highly recommend this read. It's eye-opening and challenges many myths about millionaires, providing practical insights into achieving financial independence. Perhaps the secret to getting wealthy might just be embracing our inner Average Joe! 🛻

Is it worth reading? Reviews Summary

The Millionaire Next Door is rated 4.7 on Amazon and 4.1 on Goodreads.

Positive reviews say: + Eye-opening and unexpected truths + Data-driven research + Motivational for financial discipline

Criticism: - Old examples - Repetitive content - Overemphasis on frugality

6. The Richest Man in Babylon by George S. Clason (5 mentions)

What is The Richest Man in Babylon about?

What are the key takeaways?

- 🏦 1. Pay Yourself First: Start by saving 10% of your earnings for your future self, before paying anyone else

- ✂️ 2. Lower Your Expenses: Living within our means is about drawing the line between our needs and desires

- 📈 3. Let Money Work For You: To become wealthy, our savings must be transformed into passive income sources through investing

Why should you read it?

The book’s advice is straightforward but powerful, teaching not just to save, but to actively invest in our future selves. It's inspiring to see how applicable these ancient principles are today, and I can't recommend this book enough to anyone looking to improve their financial health. It's kind of like hearing life lessons from a wise and wealthy grandfather, but with more camels. 🐪

Is it worth reading? Reviews Summary

The Richest Man in Babylon is rated 4.7 on Amazon and 4.3 on Goodreads.

Positive reviews say: + Timeless principles + Simple rules + Engaging story format

Criticism: - Too simplistic for some readers - Repetitive writing

7. Your Money or Your Life by J. Dominguez and V. Robin (5 mentions)

—Joe Dominguez Vicki Robin

What is Your Money or Your Life about?

What are the key takeaways?

- 🗝️ 1. Value Savings as the Path to Freedom: Recognize how escaping the cycle of endless debt opens the door to financial freedom

- ⏳ 2. Treat Money as Life Energy: Understand that money represents your precious, irreplaceable life energy - and deserves careful management

- 🙌 3. Let Go of Financial Regrets: Reflect on past financial decisions with "no shame, no blame" - embracing a mindset of learning and growth

Why should you read it?

I recommend this book to anyone who feels caught in the cycle of earning and spending without feeling fulfilled. These authors are like financial therapists, helping us let go of our old guilt around money, while crafting a plan to change our lives. 👩⚕️👨⚕️

Is it worth reading? Reviews Summary

Your Money or Your Life is rated 4.5 on Amazon and 4.0 on Goodreads.

Positive reviews say: + Transformative approach to money + Practical tools for financial planning

Criticism: - Repetitive content - Requires major lifestyle changes

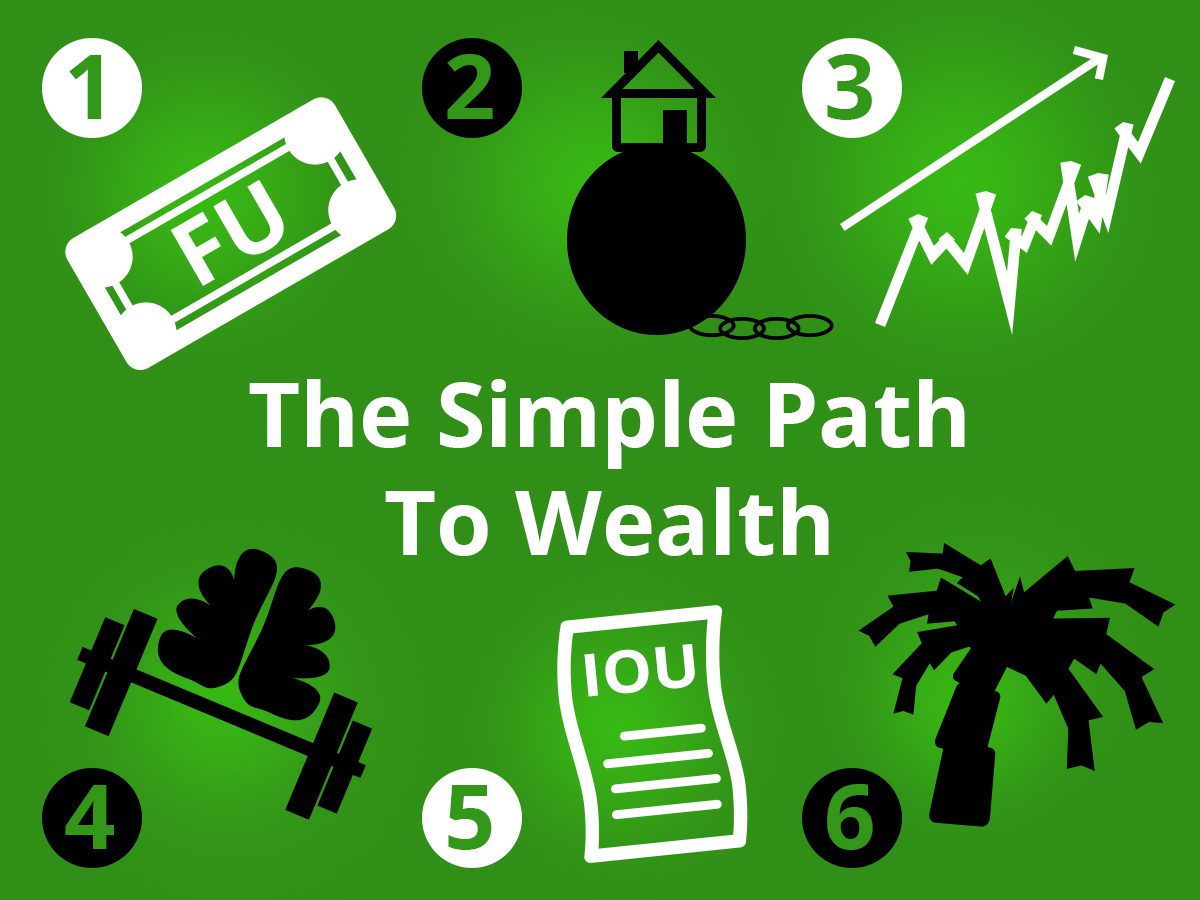

8. The Simple Path to Wealth by JL Collins (4 mentions)

—JL Collins

What is The Simple Path to Wealth about?

What are the key takeaways?

- 🤸♂️ 1. Get F-You Money: Achieve freedom by saving enough to cover several months of expenses

- 💳 2. Pay Off Debt Quickly: Carrying a lot of debt is the biggest obstacle to wealth

- 📊 3. Invest in Stock Index Funds: The safer way to grow wealth is by investing in ALL the stocks in the market

Why should you read it?

I recommend this book because it's more than just financial advice; it's a roadmap to a stress-free financial life. Whether you're just starting or looking to refine your financial strategy, this book is a beacon of clarity. Plus, this is Reddit’s #1 recommended personal finance book today. You can’t argue with the internet, right? 👽

Is it worth reading? Reviews Summary

The Simple Path to Wealth is rated 4.7 on Amazon and 4.5 on Goodreads.

Positive reviews say: + Clear and concise + Practical financial strategies

Criticism: - U.S.-centric directions - Too simplistic for some

9. Broke Millennial by Erin Lowry (4 mentions)

“Trying to change how you spend or save money without understanding why it’s difficult in the first place probably means you’ll slip up.” —Erin Lowry

What is the book about?

Broke Millennial is a relatable and engaging guide for young adults to navigate their finances. Erin Lowry addresses the challenges millennials face, from managing student loans to understanding complex financial terminology. The book emphasizes practical, easy-to-understand advice for taking control of personal finances early in life.

What do the reviews say?

| ⭐️ 4.6 on Amazon | ⭐️ 3.9 on Goodreads |

| 👍 Positive: Relatable and easy to understand — Practical and actionable steps — Engaging and humorous approach | 👎 Criticism: Focused mainly on beginner financial concepts |

Why should you read it?

…For a real talk about money that doesn’t put you to sleep! 😂 This book is like chatting with a savvy friend who knows all the ins and outs of dollars and cents. Lowry dives into the nitty-gritty of millennial money issues without the financial gobbledygook. Perfect if you’re tired of hearing the same old money advice.

Top lessons include:

- 💳 Understanding Debt: Learn how to tackle different types of debt, especially student loans, and the importance of a good credit score.

- 📊 Budgeting Made Easy: Lowry offers straightforward strategies for creating and sticking to a budget that doesn’t feel restrictive.

- 🎯 Setting Financial Goals: The book encourages readers to define their own financial success and provides steps to achieve these goals, helping to transform their relationship with money.

10. I Will Teach You to Be Rich by Ramit Sethi (4 mentions)

“The single most important thing you can do to be rich is to start early.” —Ramit Sethi

What is the book about?

I Will Teach You to Be Rich is an actionable guide to organize your finances and live your personal ‘Rich Life.’ Ramit Sethi focuses on conscious spending, so we can buy what we want guilt-free, while also saving money. He gives specific recommendations for credit cards, banks, and investing.

What do the reviews say?

| ⭐️ 4.7 on Amazon | ⭐️ 4.2 on Goodreads |

| 👍 Positive: Many people liked the very specific actionable steps that tell you exactly what to do, like which accounts to open at which bank. | 👎 Criticism: Some people said the book contains no new information (just save money and invest in index funds). |

Why should you read it?

What’s not to like about a finance book that kicks off with the tagline: “Buy as many ☕ lattes as you want”? Too many personal finance books are dry, boring and repetitive, which turns people off. This author offers the exact opposite—with plenty of colourful 😂 jokes and the real, honest truth about money. (He even spills the beans on the conversation he had with his wife before they signed a 💍 prenup!)

Top lessons include:

- 💸 Financial Automation. Nobody enjoys paying bills, so why not make it automatic? So that every month your bills are paid and your investment accounts funded without you needing to do anything, and you don’t need to think about it anymore!

- 🛍️ Conscious Spending. Rather than focusing on limiting spending, this is about making a plan for spending on what really makes you happy, so you can live our personal ‘Rich Life’ guilt-free.

- ⏰ Begin Today. It’s better to start now than waiting to get everything perfect, when it comes to saving money and investing. What really matters is being in the game sooner, because of the power of compound interest.

11. The Little Book of Common Sense Investing by John Bogle (3 mentions)

“Don’t look for the needle in the haystack. Just buy the haystack!” —John Bogle

What is the book about?

The Little Book of Common Sense Investing is about how to better invest your money for retirement. The main idea is that you should buy and hold low-cost index funds, rather than buying individual stocks or actively managed mutual funds. John Bogle founded Vanguard, a pioneer of index fund investing.

What do the reviews say?

| ⭐️ 4.7 on Amazon | ⭐️ 4.2 on Goodreads |

| 👍 Positive: Many readers appreciated the easy-to-understand writing style, which helps beginner investors avoid common mistakes. | 👎 Criticism: Some noted the book could have been shorter, as it tends to repeat the same main point over and over again. |

Why should you read it?

John Bogle is like the 👴🏻 cool grandpa of the investing world, who’s inspired tons of writers, including the author of “The Simple Path to Wealth.” His big breakthrough? A fact that now seems obvious: that the financial industry is more interested in lining their own pockets than ours. I mean, who would’ve guessed, right? 🤷♀️ But hey, thanks to him and others, we now have some smart new strategies for how to invest our money.

Top lessons include:

- 🌐 Low-Cost Index Funds: Simplify your investing through buying index funds, which are like a collection of all the stocks in the market. This approach minimizes fees, promotes diversification, and provides greater average returns than actively managed funds.

- 🕵️ Beware of Fees: Larger costs and fees are a major downside of buying individual stocks or actively managed mutual funds. These include management fees, buying/selling fees, and greater capital gains taxes.

- 🙉 Ignore Market Noise: Instead of buying and selling based on current news or trends, simply buy and hold. By investing for the long-term, and maintaining patience and discipline, you’ll benefit from greater compounding returns.

12. The Bogleheads’ Guide to Investing by Lindauer, LeBoeuf, and Larimore (3 mentions)

“Index investing is an investment strategy that Walter Mitty would love. It takes very little investment knowledge, no skill, practically no time or effort-and outperforms about 80 percent of all investors.”

What is the book about?

The Bogleheads’ Guide to Investing is a comprehensive resource for anyone looking to understand the basics of investing. Inspired by the investment philosophy of Vanguard founder John C. Bogle, the book breaks down complex investment concepts into digestible pieces. It covers everything from asset allocation to tax strategies, emphasizing long-term, low-cost investment approaches.

What do the reviews say?

| ⭐️ 4.7 on Amazon | ⭐️ 4.3 on Goodreads |

| 👍 Positive: Comprehensive and straightforward — Practical investment strategies — Accessible to beginners | 👎 Criticism: Does not cover advanced investment strategies or concepts |

Why should you read it?

For a no-nonsense guide to growing your wealth. This book is like a roadmap to investment, steering you clear of the overly complex schemes of the financial industry. It’s perfect for beginners and anyone who wants to make smart investment choices without feeling overwhelmed. The Bogleheads’ approach simplifies investing, making it accessible and manageable for everyone, not just the financial wizards.

Top lessons include:

- 📈 Long-Term Investing: Learn the importance of a long-term perspective in building wealth.

- 💰 Low-Cost Index Funds: Discover why low-cost index funds are often the best investment choice.

- 🧮 Asset Allocation: Understand how to diversify your investments to balance risk and return.

- Chime.com – 10 Financial Literacy Books

- Planswell – 10 of the best financial literacy books

- Reddit r/personalfinance thread – favorite beginner books on financial literacy

- Reddit r/phinvest thread – good books on financial literacy

- Quora – recommended books for learning financial literacy

- Purewow.com – 15 financial literacy books

- VantageFit.io – 12 best financial literacy books

- HavenLife.com – Four must-read financial literacy books

- FourMinuteBooks – 14 Best Finance Books

Community Notes