1. 🔍 Write down a monthly budget

Keep an eye on your income and expenses to understand where your money is going. Then make sure to set spending limits for different categories. Remember that budgeting can be fun, too, just like a game of “Monopoly” but with real money!

Growth Hack: 🐖 Follow”The 50/30/20 Rule.” This is a commonly recommended personal finance guideline that suggests dividing your income into three parts: spend 50% on what you need, 30% on what you want, and 20% to build your savings.

A budget is people telling their money where to go instead of wondering where it went.

John Maxwell (mentioned in “The Total Money Makeover” by Dave Ramsey)

2. 📅 Pay yourself first

Automatically set aside a portion of your income for savings or investments before allocating money for other expenses. Many popular financial authors call this “paying yourself first.”

Growth Hack: 🤖 Automate your wealth building. Most banks now allow you to automatically deposit a certain amount every 2 weeks into a retirement account. This is a great idea because then you never again have to remember to set money side—it happens by default.

Pay yourself first. (…) A part of all you earn is yours to keep. It should be not less than a tenth no matter how little you earn.

“The Richest Man in Babylon” by George S. Clason

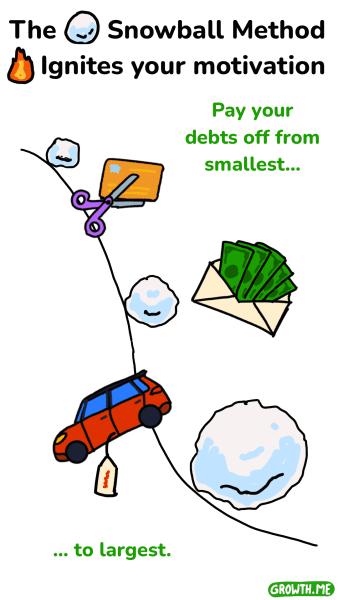

3. 💳 Eliminate or reduce debt

Focus on paying off high-interest debt as quickly as possible, and avoid taking on new unnecessary debt.

Growth Hack: ❄️ The Snowball Method from Dave Ramsey says the best way to eliminate debt is to list your debts from smallest to largest, and pay them off in that order. While this approach is less ‘mathematically correct’ than paying off the highest interest loans first, it’s more ‘psychologically correct’ because it allows us to experience some quick wins that increase our motivation to continue getting financially free.

4. 🧘♀️ Spend mindfully

Be intentional with your spending, prioritize your needs over wants, and avoid impulse purchases.

Growth Hack: ✏️ Keep a daily money journal. Record every single expense and income that you receive, to increase your financial awareness of where your money is going.

Track every cent that comes into or goes out of your life.

“Your Money or Your Life” by Vicki Robin and Joe Dominguez

5. 💸 Slash those expenses!

Look for areas where you can reduce costs, whether it’s cutting forgotten subscriptions you don’t use anymore or cooking more food at home, perhaps even finding cheaper housing or transportation.

Growth Hack: 💳 Review your bank and credit card statements. Go through your financial statements from the last few months to identify recurring expenses and subscriptions that you no longer use or need.

If you will live like no one else, later you can live like no one else.

“The Total Money Makeover” by Dave Ramsey

6. 🏦 Increase your income

Explore new ways to bring in extra cash through side hustles, freelance work, or investing in your skills to advance in your career. Hey, maybe getting an extra certification to impress your next boss or employer wouldn’t be such a bad idea, right? 🤷

Growth Hack: 🤝 Negotiate your salary: Research the market value for your position and skillset, and be prepared to negotiate for a higher salary or a raise during performance reviews or job interviews. For more specific tips on negotiation, see Never Split the Difference by Chris Voss, one of the FBI’s former top negotiators.

The main reason people struggle financially is because they have spent years in school but learned nothing about money. The result is that people learn to work for money… but never learn to have money work for them.

“Rich Dad Poor Dad” by Robert T. Kiyosaki

7. 🤑 Live frugally

Embrace a more minimalistic and frugal lifestyle, focusing on experiences and relationships rather than material possessions.

Growth Hack: ⏰ Limit impulse purchases. Implement a waiting period (such as 2 weeks) before making non-essential purchases to ensure you truly need and want the item.

To build wealth, minimizing your spending is essential.

“The Simple Path to Wealth” by J.L. Collins

8. 🛍 Shop smarter

Take advantage of sales, discounts, and coupons to lower the cost of the items you need. It’s not about being cheap—sometimes the most financially smart thing you can do is buy a higher-quality item that will last!

Growth Hack: 📆 Time your purchases. Wait for seasonal sales or special events, such as Black Friday or end-of-season sales, to buy items at a discount.

Most millionaires prefer to buy quality items, especially if these items are on sale or have a discount.

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

9. 🛡 Build an emergency fund

Save up an emergency fund to cover unexpected expenses and reduce the need for debt during financial setbacks.

Growth Hack: 💵 Keep the fund accessible. Store your emergency fund in a high-yield savings account, a money market fund, or another liquid account that allows easy access without penalties.

Save $1,000 cash as a starter emergency fund. (…) Having an emergency fund turns a crisis into an inconvenience.

“The Total Money Makeover” by Dave Ramsey

10. 🎯 Keep your dream end goal in mind

Establishing exciting long-term financial goals that get your heart beating faster can help you stay motivated with your spending and saving decisions.

Growth Hack: 🖼 Create a vision board for your phone/computer background. This can be a collage or slideshow of inspiring images, such as your dream home, vacation, or retirement. It’s a visual reminder of why you are sacrificing today—for a more secure and relaxed future.

Financial freedom is achieved when your passive income exceeds your expenses.

“Rich Dad Poor Dad” by Robert T. Kiyosaki

In summary, living below your means is not only doable, but it can also lead to a more secure financial future. By analyzing your spending habits, crafting a practical budget, and planning for the long term, you can set yourself on the path to financial success. And hey, your wallet will be happy too! 😂

Ready to take your financial game to the next level? ➡️ Then sign up for a free account on Growth.me today and gain access to all the books mentioned in this article.

Community Notes