In today’s rapidly-changing world, having financial literacy is more important than ever. Unfortunately, many of us were never taught essential knowledge about money, investing, and personal finance.

In school, we were too busy learning about mitochondria being the powerhouse of the cell, right? 🤷♂️

Take a look at these sobering statistics:

- 37% (over one-third!) of Americans would not have $400 cash to pay for an emergency expense. (From a 2022 Federal Reserve report.)

- 36% have more 💳 credit card debt than emergency savings. (From a 2023 Bankrate survey.)

- 25% have no personal retirement savings, as in none at all. (From a different Fed report.)

The good news? It’s never too late to begin learning and transform your financial life.

But with literally thousands of finance books 📚 published every year, which ones are worth reading? We’ve done the research for you, scanning hundreds of book reviews and dozens of reading guides to find the best finance books of all time. (Check our references at the bottom.)

We discovered there is no ONE finance book that is best for everyone, so we chose the best books in four categories. Best of all, we’ve even summarized most of these finance books on this website, so you can get smart about money faster.

Table of contents

Best Finance Books Of All Time

1. I Will Teach You To Be Rich by Ramit Sethi

What is the book about?

“I Will Teach You to Be Rich” by Ramit Sethi is a practical guide to personal finance for young adults. It offers straightforward advice on saving, investing, and spending wisely, emphasizing the importance of automating finances and investing in low-cost index funds. Sethi’s approach is action-oriented, aiming to demystify financial independence with clear, actionable steps tailored to long-term success.

Our favourite quote

“The single most important thing you can do to be rich is to start early.” — Ramit Sethi

Why should you read it?

After diving into “I Will Teach You to Be Rich” by Ramit Sethi, I was genuinely surprised by how much my perspective on money and personal finance changed. Sethi breaks down complex financial concepts into relatable, actionable steps that feel manageable and even exciting to implement. His approach to automating savings, investing wisely, and spending guilt-free on what truly matters has been a game-changer for me.

I recommend this book to anyone who feels overwhelmed by the idea of getting their finances in order—it’s a practical, no-nonsense guide that can really set you on the path to financial freedom. It’s like having a friend who’s really good with money, guiding you through the maze. And hey—what’s not to love about a finance book that kicks off with the sentence: “Buy as many lattes as you want”? ☕️

What are the key takeaways?

- 💸 Financial Automation. Nobody enjoys paying bills, so why not make automate it? Ramit explains how to automatically pay bills and invest money every month, so you don’t need to think about it anymore!

- 🛍️ Conscious Spending. Rather than focusing on limiting spending, make a plan for spending your hard-earned cash on things that truly make you happy. So you can live your personal ‘Rich Life’ —guilt-free!

- ⏰ Begin Today. It’s better to start now than waiting to learn everything, because when it comes to growing wealth through investing, the power of compound interest is almost everything.

What do the reviews say?

| ⭐️ 4.7 on Amazon | ⭐️ 4.2 on Goodreads |

| 👍 Positive: + Specific actionable steps + Engaging fun read | 👎 Criticism: – For finance enthusiasts, no new information – Author’s jokes are not for everyone |

2. The Psychology of Money by Morgan Housel

—Morgan Housel

What is The Psychology of Money about?

What are the key takeaways?

- ⏰ 1. Understand True Wealth: Happiness increases from having control over one's time, not showing off material things

- 💰 2. Compound Interest is Unbelievable: Warren Buffett's "real secret" is not investing genius, but consistency over a long time

- 🆘 3. Make Room for the Unexpected: Secure your financial safety with a margin of safety for errors and tough times

Why should you read it?

I recommend this book because it's not just about getting rich; it's about cultivating a healthier, more self-aware approach to managing your finances and life. It's a must-read for anyone looking to navigate the complex world of money with a clearer mind.

Is it worth reading? Reviews Summary

The Psychology of Money is rated 4.7 on Amazon and 4.4 on Goodreads.

Positive reviews say: + Deep insights + Easy to read + Well-researched

Criticism: - Somewhat repetitive themes - Not a step-by-step guide

3. The Simple Path to Wealth by JL Collins

—JL Collins

What is The Simple Path to Wealth about?

What are the key takeaways?

- 🤸♂️ 1. Get F-You Money: Achieve freedom by saving enough to cover several months of expenses

- 💳 2. Pay Off Debt Quickly: Carrying a lot of debt is the biggest obstacle to wealth

- 📊 3. Invest in Stock Index Funds: The safer way to grow wealth is by investing in ALL the stocks in the market

Why should you read it?

I recommend this book because it's more than just financial advice; it's a roadmap to a stress-free financial life. Whether you're just starting or looking to refine your financial strategy, this book is a beacon of clarity. Plus, this is Reddit’s #1 recommended personal finance book today. You can’t argue with the internet, right? 👽

Is it worth reading? Reviews Summary

The Simple Path to Wealth is rated 4.7 on Amazon and 4.5 on Goodreads.

Positive reviews say: + Clear and concise + Practical financial strategies

Criticism: - U.S.-centric directions - Too simplistic for some

Best Finance Books For Beginners

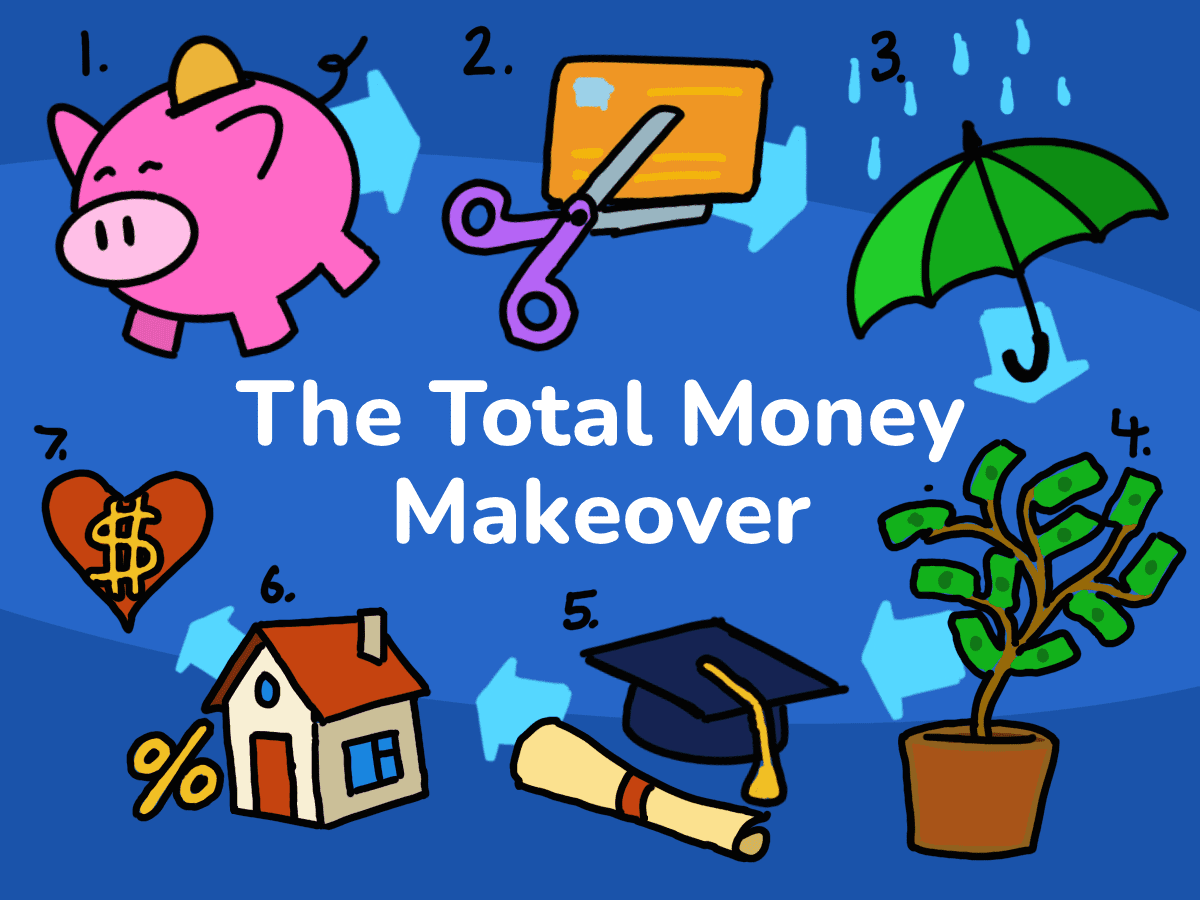

4. The Total Money Makeover by Dave Ramsey

What is The Total Money Makeover about?

What are the key takeaways?

- 💰 1. Build a Mini Emergency Fund First: Start your financial journey by saving $1,000, creating an initial safety net

- ❄️ 2. Tackle Debt with the Snowball Method: Begin paying off your debts in order from smallest to largest, to build momentum and motivation

- 🏦 4. Set Aside 15% For Retirement: Dave Ramsey's personal strategy is to invest 15% of income, ensuring a comfortable retirement

Why should you read it?

If you're feeling stuck in a cycle of debt and financial stress, I highly recommend giving this book a read. There’s nothing complicated about Dave Ramsey's advice, folks! He just provides us with a common sense financial plan that works—if we’re willing to work the plan! 💪

Is it worth reading? Reviews Summary

The Total Money Makeover is rated 4.7 on Amazon and 4.2 on Goodreads.

Positive reviews say: + Practical steps + Motivational + Step-by-step plan

Criticism: - One-size-fits-all - Aggressive debt approach - Religious overtones

5. Your Money or Your Life by Joe Dominguez and Vicki Robin

—Joe Dominguez Vicki Robin

What is Your Money or Your Life about?

What are the key takeaways?

- 🗝️ 1. Value Savings as the Path to Freedom: Recognize how escaping the cycle of endless debt opens the door to financial freedom

- ⏳ 2. Treat Money as Life Energy: Understand that money represents your precious, irreplaceable life energy - and deserves careful management

- 🙌 3. Let Go of Financial Regrets: Reflect on past financial decisions with "no shame, no blame" - embracing a mindset of learning and growth

Why should you read it?

I recommend this book to anyone who feels caught in the cycle of earning and spending without feeling fulfilled. These authors are like financial therapists, helping us let go of our old guilt around money, while crafting a plan to change our lives. 👩⚕️👨⚕️

Is it worth reading? Reviews Summary

Your Money or Your Life is rated 4.5 on Amazon and 4.0 on Goodreads.

Positive reviews say: + Transformative approach to money + Practical tools for financial planning

Criticism: - Repetitive content - Requires major lifestyle changes

6. The Millionaire Next Door by Thomas J. Stanley and William D. Danko

—Thomas J. Stanley William D. Danko

What is The Millionaire Next Door about?

What are the key takeaways?

- 🐷 1. Embrace Frugality: Financial planning and saving money is essential for creating your foundation for investment and future wealth

- 🏎️ 2. Avoid Status Traps: One of the biggest obstacles to wealth is the temptation to live a high-status lifestyle

- 🌱 3. Acquire Assets: Millionaires grow wealth effectively by looking beyond their income and accumulating financial assets

Why should you read it?

If you're curious about what it really takes to build wealth over a lifetime, without the glitz and glamour often portrayed in the media, I highly recommend this read. It's eye-opening and challenges many myths about millionaires, providing practical insights into achieving financial independence. Perhaps the secret to getting wealthy might just be embracing our inner Average Joe! 🛻

Is it worth reading? Reviews Summary

The Millionaire Next Door is rated 4.7 on Amazon and 4.1 on Goodreads.

Positive reviews say: + Eye-opening and unexpected truths + Data-driven research + Motivational for financial discipline

Criticism: - Old examples - Repetitive content - Overemphasis on frugality

Best Finance Books for Young Adults

7. The Richest Man in Babylon by George S. Clason

What is The Richest Man in Babylon about?

What are the key takeaways?

- 🏦 1. Pay Yourself First: Start by saving 10% of your earnings for your future self, before paying anyone else

- ✂️ 2. Lower Your Expenses: Living within our means is about drawing the line between our needs and desires

- 📈 3. Let Money Work For You: To become wealthy, our savings must be transformed into passive income sources through investing

Why should you read it?

The book’s advice is straightforward but powerful, teaching not just to save, but to actively invest in our future selves. It's inspiring to see how applicable these ancient principles are today, and I can't recommend this book enough to anyone looking to improve their financial health. It's kind of like hearing life lessons from a wise and wealthy grandfather, but with more camels. 🐪

Is it worth reading? Reviews Summary

The Richest Man in Babylon is rated 4.7 on Amazon and 4.3 on Goodreads.

Positive reviews say: + Timeless principles + Simple rules + Engaging story format

Criticism: - Too simplistic for some readers - Repetitive writing

8. Rich Dad Poor Dad by Robert Kiyosaki

What is Rich Dad Poor Dad about?

What are the key takeaways?

- 🏦 1. Understand Assets vs Liabilities: 'The Rich' buy assets that generate income, while 'The Poor' buy liabilities that cost them money (like a house and cars)

- 🧠 2. Master Your Psychology: We all have inner obstacles to wealth like fear, arrogance and laziness

- ⚖️ 3. Maximize Tax Advantages: Having a corporation can offer you many benefits including tax savings

Why should you read it?

Now, I know some people think the author is more of a salesman or even call him a fraud because of how he presents his ideas. But on the flip side, a lot of readers feel really fired up after reading the book. It's easy to understand and makes you see money in a whole new way, pushing you to take action towards financial freedom. 💸

Is it worth reading? Reviews Summary

Rich Dad Poor Dad is rated 4.7 on Amazon and 4.1 on Goodreads.

Positive reviews say: + Thought-provoking + Inspires entrepreneurship + Simple to understand

Criticism: - Oversimplified concepts - Undermines education and careers

Best Finance Books for Investing

9. A Random Walk Down Wall Street by Burton Malkiel

What is the book about?

“A Random Walk Down Wall Street” by Burton G. Malkiel is a guide to investing that argues against the idea that stock market success is the result of expert stock picking or market timing. He promotes long-term investment strategies, particularly index fund investing, as the most effective approach to building wealth.

Our favourite quote

“Never buy anything from someone who is out of breath.” — John Bogle

Why should you read it?

After reading “A Random Walk Down Wall Street,” I felt reassured about many of the investment principles I already believed in, but with a much stronger foundation. Burton G. Malkiel’s deep dive into the “random walk” theory—that stock market movements are unpredictable and that attempting to outguess the market is futile—really hit home for me.

For anyone who’s ever suspected that there might not be much skill in short-term stock picking, this book offers powerful affirmation, backed by thorough research and analysis. The book reinforces the idea that focusing on long-term investing, especially through index funds, is not just sensible but essential. 📈

What are the key takeaways?

- 🎲 Random Walk Theory: The book introduces and extensively discusses the random walk theory, which posits that stock market prices move unpredictably and that it’s impossible to consistently outperform the market by predicting future movements. This challenges the conventional wisdom of active trading and market timing.

- 🔍 Efficient Market Hypothesis (EMH): Malkiel explains the efficient market hypothesis, suggesting that all available information is already reflected in stock prices, making it futile for investors to seek undervalued stocks or predict trends for financial gain.

- 💵 Value of Index Funds: A significant recommendation from Malkiel is the investment in index funds, which mirror the performance of a market index. This approach is favored for its low costs and the diversification it offers, aligning with his advice for long-term investment strategies over speculative trading.

What do the reviews say?

| ⭐️ 4.7 on Amazon | ⭐️ 4.1 on Goodreads |

| 👍 Positive: + Accessible to beginners + Comprehensive coverage of investment topics + Evidence-based arguments | 👎 Criticism: – May feel dated – Not all agree experts agree with his criticisms of active management |

10. The Little Book of Common Sense Investing by John Bogle

What is the book about?

“The Little Book of Common Sense Investing” by John C. Bogle focuses on the power of investing in low-cost index funds for long-term financial success. Bogle, the founder of Vanguard Group, advocates for a simple, straightforward investing approach. He emphasizes that the key to building wealth is to focus on low costs, broad diversification, and a long-term perspective, dismissing the need for complicated strategies or frequent trading.

Our favourite quote

“The expectations market is about speculation. The real market is about investing. The stock market, then, is a giant distraction to the business of investing.” — John Bogle

Why should you read it?

John Bogle is like the cool grandpa 👴🏻 of the investing world, who’s inspired tons of other popular finance authors to copy his approach. Bogle’s main point—that investing in low-cost index funds is one of the best ways to achieve financial growth—really resonated with me. He lays out the case so plainly and convincingly, backing up his arguments with solid data and logic.

It’s refreshing to see how a straightforward strategy can be so powerful, without the need for constantly buying and selling stocks. Bogle points out something that now seems obvious: that the financial industry is more interested in lining their own pockets than ours. I mean—who would’ve guessed, right? 🤑

What are the key takeaways?

- 🌐 Low-Cost Index Funds: Simplify your investing through buying index funds, which are like a collection of all the stocks in the market. This approach minimizes fees, promotes diversification, and provides greater average returns than actively managed funds.

- 🕵️ Beware of Fees: Larger costs and fees are a major downside of buying individual stocks or actively managed mutual funds. These include management fees, buying/selling fees, and greater capital gains taxes.

- 🙉 Ignore Market Noise: Instead of buying and selling based on current news or trends, simply buy and hold. By investing for the long-term, and maintaining patience and discipline, you’ll benefit from greater compounding returns.

What do the reviews say?

| ⭐️ 4.7 on Amazon | ⭐️ 4.2 on Goodreads |

| 👍 Positive: + Clear and simple to read + Focus on long-term strategy and reducing costs | 👎 Criticism: – Can be repetitive – Limited perspective on other investment strategies |

- Goodreads Finance Shelf

- Goodreads Personal Finance Shelf

- Goodreads List – Best Books About Money

- Investopedia List of Best Finance Books

- Amazon.com Finance Best Sellers

- Audible Best Sellers in ‘Money & Finance’

- Reddit r/PersonalFinance Reading List Wiki

- Reddit r/PersonalFinance Book Recommendations Post (6K upvotes)

- Additional Reddit Discussions: One, Two, Three, Four, Five, Six, Seven

- Four Minute Books List

- Morningstar List

- Business Insider List

- Pan Macmillan – 40 best finance books

- Fox Business – 5 must-read finance books

- Tim Denning – Read these personal finance books

- Erin Gobler – 8 Best Personal Finance Books

Community Notes